OTP & Authentication

Aug 28, 2024

The complete guide to SMS OTP

As companies and consumers are evolving more and more online, the need to secure their users online accounts and information has become crucial for businesses. And the most popular solution can be spelled in just six letters: SMS OTP.

But what exactly is SMS OTP, and how does it work? In this guide, we’ll cover everything you need to know about SMS OTP, including its benefits and how to implement it effectively.

What is SMS OTP?

SMS OTP (for One-Time Password), is a temporary and secure password sent via SMS (Short Message Service) to a user’s mobile phone. It functions as a security measure to authenticate a user’s identity.

The OTP typically takes the form of a 4 to 8 digits code that is randomly generated. It can only be used once and expires after a very short period (often just a few minutes).

Companies use SMS OTPs to enhance security in their two-factor authentication (2FA) setups.

How does SMS OTP work?

Let's consider a dating app that aims to protect the privacy of its users (especially those who don’t want to reveal their cheesiest pickup lines to the public).

When one of their user triggers an action that requires an OTP, like an attemps to log in to a new device, here’s what happen:

The app doesn't recognize the device. It suggests sending a verification code by SMS to confirm the user's identity.

The app requests automatically its SMS OTP provider to generate and send an OTP to the user’s mobile number.

The SMS OTP provider’s algorithm generate a random 4-digit code and send it to the user”s phone.

The user enters the OTP into the dating app. The SMS OTP generator’s algorithm validate the code instantly if it’s correct.

And voilà! The user can go back to the dating game on its brand new device.

And the best part is that it all happened automatically, in less than a minute. Everyone is happy: the user because their data is clearly secured and the dating app because it's safe from hackers.

Example of SMS OTP

SMS OTPs usually follow the same pattern:

{{Code}} is your validation code for {{Name of the app}}.

Some business will want to customize their message to align with their brand identity and make this notification part of the overall user experience. For instance, Prelude’s client and social app BeReal, use their tagline at the end of their OTP message:

“7860 is your validation code for BeReal. Your friends for real.”

TOTP or HOTP: What’s the difference?

SMS OTPs usually fall in two different categories, depending on the algorithm used to generate them: HOTP (HMAC-Based One-Time Password) and TOTP (Time-Based One-Time Password).

The key difference between these two is the moving factor that changes each time a code is generated by the algorithm.

The HOTP is counter-based. The counter increases each time an OTP is requested. This means the code remains valid until it is used or the counter increases.

The TOTP is time-based, valid only for a specific interval. Once the interval espases, a new OTP can be generated.

Read more on this topic in our blogpost: TOTP vs HOTP: What's the difference (and which is better)?

The (many) use cases of SMS OTP for business

Business can use SMS OTPs in many ways to enhance the security and trust of their users. The most common use cases include:

User registration: Verify your new users identity and phone number during the account creation process.

Two-factor authentication: Add an extra layer of security to the username and password login process.

Password resets: Secure the process of resetting a forgotten or compromised password to prevent your users of being blocked out of their accounts.

New device authentication: When users log in from new or unrecognized devices, requesting an SMS OTP can help ensure that they are authorized to do so.

Passwordless authentication: If you want to allow your users to sign up using their mobile number only, sending an OTP helps you secure their authentication.

Transaction verification: For any transaction, such as a transfer or an online payment, send an SMS OTP to verify the validity of the transaction.

Changing account details: When a user wishes to change sensitive account information, such as their email address or password, double check its authenticity with an OTP.

Activating bank payment cards: Newly issued bank cards often require activation via OTP to ensure they are in the possession of the rightful owner. This adds an extra layer of security and ensures that only the cardholder can activate and use the card.

We could mention many other use cases, such as securing access to files or integrating third parties, but by now you should have understood that virtually any sensitive action triggered by a user's behaviour could benefit from an extra layer of security thanks to an SMS OTP.

How safe is SMS OTP?

SMS OTPs are very effective at mitigating risks, due to their randomness.

For a random four-digit code, a fraudster would need to guess each number correctly in under five minutes. That's 10 possibilities, four times. Mathematically, that translates to a one in a 10,000 chance of getting an OTP right.

Adding to that randomness is the fact that an OTP is valid only once and is time-sensitive. It’s like trying to find a needle in a haystack, except the needle moves to a different haystack every minute!

But we have to address the elephant in the room: SMS OTP is not flawless.

Due to their medium, SMS OTPs can be subject to potential threats. SIM swapping, SS7 protocol vulnerabilities, and social engineering are all well-known tactics used by hackers that can weaken SMS OTPs as a strong authentication factor.

It is a risk companies can mitigate by educating their users, but more importantly, by implementing an secure OTP provider that actively prevents fraud.

💡 For instance, at Prelude, we block 99% of spam and fraud attacks for our customers by using a cross signal risk scoring to identify spam with the best accuracy. Our Watch API analyzes dozens of digital signals, including SIM card portability, to prevent SIM swap attacks targeting your users. Our end-goal is that our clients only send OTP to real users, without having to resort to blocking entire countries.

The benefits of SMS OTP

Enhanced security and fraud reduction

As discussed earlier, SMS OTPs provide a vital layer of security by utilizing an unguessable, time-sensitive code. This helps companies fight fraud and protect user accounts and information from unauthorized access while reducing the risks associated with solely relying on user passwords.

Build customer trust

Over 25% of online users have abandoned transactions due to concerns about an app or website's security. Implementing SMS OTP in your two-factor authentication system can help eliminate these barriers to conversion by reassuring customers that their data and financial information are safe with your company.

Accessible to all your users

SMS is the most used type of 2FA worldwide. It is easily accessible to all users with a phone, as it doesn’t require any additional apps or technology, and leverages a medium that users are already familiar with.

SMS is universally supported by mobile network operators, making it the ideal channel for reaching users on a global scale.

Instant user authentication

With high delivery and open rates, SMS allow your users to receive and use their OTPs instantly, facilitating a smooth user authentication experience.

Ease of implementation

Implementing SMS OTP into your systems is straightforward and doesn’t require significant infrastructure changes or extensive resources. At Prelude, we’ve witnessed companies launch their OTP systems in under an hour with just a single team member!

Scalability

SMS being a worldwide channel, your OTP needs can grow as the same pace as your company does. You can expand to new markets without needing to rely on new vendors or channels, especially if you work with an OTP service that already integrates multiple providers.

How to implement SMS OTP in your application?

Now that you’re convinced that your company needs SMS OTPs, what are the next steps? Deploying such a service can actually be quite quick and easy.

1. Chose your OTP service provider

In a previous article, we listed the features to look for in an SMS OTP provider.

In order to chose the best one for your company, you need to have a clear must-have features list in mind, whether it’s speed and reliability, ease of implementation, integrations or pricing.

Also make sure to check if the provider offers SDKs for your preferred programming language, to ease the integration process! For instance, Prelude provide SDKs for many popular languages such as Node, Go or Python.

2. Integrate the provider SMS API

Once you made your choice, you can use your provider’s SMS API to integrate the OTP functionality into your application. Your provider should share with you an API key or token, so you can set up the service.

3. Test the integration

Before going all-in with your provider, make sure to test the integration. You can do so by using test phone numbers to verify that messages are received correctly, then by monitoring logs in your provider’s dashboard to make sure your users receive their OTPs.

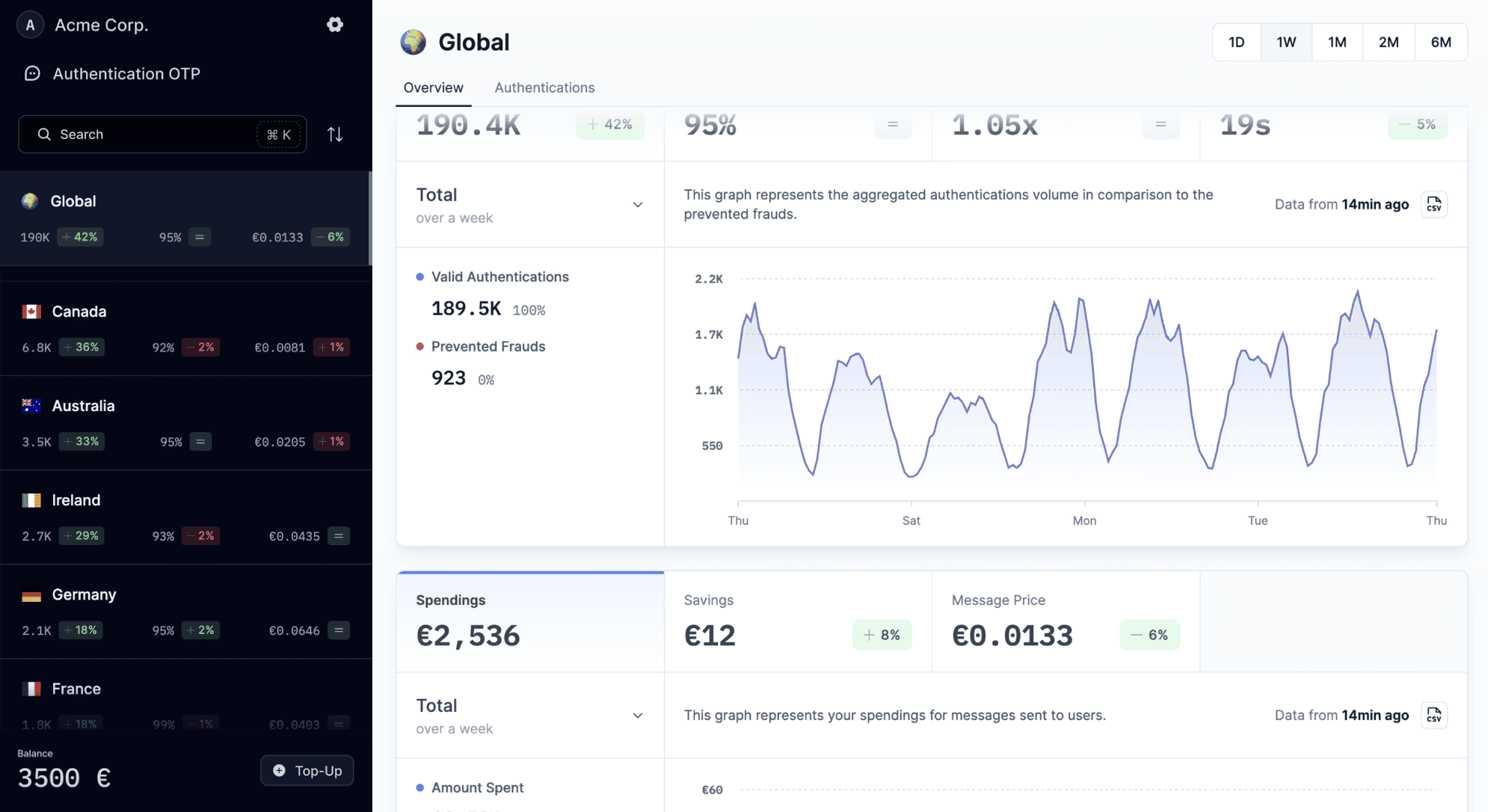

4. Monitor and scale

Once everything runs smoothly for your users, dedicate some time going forward to monitor the costs and volume of SMS sent to keep track of your acquisition performance. Some providers like Prelude give access to their clients to real-time dashboards and analytics so they can understand better their user authentication KPIs and opportunities.

Get started with SMS OTP with Prelude Verify

You can send and verify a code in 2 minutes and 3 simple steps by integrating the Prelude Verify API from any language to start sending OTP messages to your users worldwide using multiple messaging channels.

Step 1: Sign up and get your API Key

To use Prelude’s verification services, you need an API key:

Create an account on Prelude.

Navigate to the Keys section in your Settings.

Generate a new API key and store it securely.

Your API key is required to authenticate requests and should be kept private.

Step 2: Sending a verification code

To verify a phone number, the first step is to send a one-time password (OTP). Use the /v2/verification endpoint to trigger a message with a verification code. You can see all the different customizable parameters, such as code size or Sender ID, on our documentation.

Request example:

Response example:

Step 3: Checking the verification code

Once the user receives the OTP, they enter it into your app. You then verify the code using the /v2/verification/check endpoint.

Request example:

Response example:

In case of errors, such as invalid phone number or invalid request, find out how to troubleshoot them here.

Step 4: Sending fraud signals

You're all set with Prelude already! This last step is optional (but highly recommended) as it will help you leverage our API to the fullest by enabling it to mitigate fraud attacks such as SMS pumping.

You can send over 50 user signals (device model, app version, battery level, and more) to Prelude through our Mobile SDKs (for iOS, Android and React Native) for the most accurate filtering possible.

You can also start opening new countries and new messaging channels (such as WhatsApp, RCS or Viber) depending on your user verification needs.

Best practices for SMS OTP

How can you ensure your OTP drives conversions instead of losing users? Here are some best practices we recommend to our clients, based on our experience sending millions of OTPs each month.

Keep it short and sweet: Your SMS should start with the code, allowing users to enter it directly into your app without needing to open the message. If you want to add your own flavor in the message content, you can do it after the code is mentioned.

Implement fallback options: If your user has a poor cellular network reception, it’s always best to have fallback options such as WhatsApp or Viber to send your OTP. Aim for an OTP provider that can do this automatically for you.

Allow retrying for OTPs: Users that don’t receive or use their OTP on time should be allowed to ask for a new one.

How to overcome the challenges of SMS OTP?

At Prelude, we noticed that our customers come to us when they face one of the two common challenges of SMS OTP:

high bills from their OTP providers due to fraud charges,

or the need for affordable SMS verification services while developing their apps.

We address these issues with a pricing model that can reduce SMS verification costs by 30-40% and improve conversion rates. Our services include lower costs for fraud protection, multi-routing options, and a transparent dashboard that shows SMS cost breakdowns and savings.

With advanced fraud detection and real-time analytics, our clients can now effectively connect with genuine users while minimizing expenses.

Elevate your SMS verification process by booking a demo of our API or trying it out today!

Recent Articles